Russia is experiencing higher budget outlays in prosecuting the Ukraine War, but these expenditures should be considered “investments” because they will generate revenue streams for decades after the war. Russian investors have acquired at steep discounts the multi-billion dollar investments made in Russia by foreign companies; and the Russian Federation will annex many of Ukraine’s most fertile agricultural lands; and lucrative hydrocarbon reserves and mineral deposits.

Russia after the Soviet Union (1991–2022)

A popular story in the Wall Street world in which I thrived (before 9/11 set me on a different path) is how Philip Morris International (PMI) acquired the lion’s share of rights to Russia’s tobacco industry. Shortly after the Soviet Union expired on 25 Dec 1991, the corporate jet of Hans G. Storr (d. 2021), CFO of Philip Morris Companies (NYSE: PM), touched down in Moscow. Storr inked deals to acquire Soviet tobacco companies, leaving rivals like R.J. Reynolds Tobacco,1 British American Tobacco (BAT) and Japan Tobacco (JT) with less valuable rights. As of Fall 2023, “PMI ($7.9Bn) [is] at the top of the list for the revenue (including excise tax) generated in Russia by foreign companies in 2022. JT ranks #2 ($7.4Bn) and BAT ranks #5 ($4.2Bn).”

This scenario was repeated in the years following the demise of the USSR. North American, European, and Asian companies invested hundreds of billions of dollars in Russia. American franchises—Pizza Hut, McDonald’s, Burger King; and American icons like Apple, Microsoft, and Coca-Cola—acquired decrepit Soviet-era assets, developed or refurbished factories, distribution centers, and sales outlets; manufactured or imported products; and repatriated profits to their home countries. A part of these profits benefited shareholders through dividends and higher share prices.

Russia in 1991 needed this foreign investment, technical expertise, and training of sundry staff, managers, bankers, technicians, etc. because the Soviet-era economy, manufacturing, distribution, banking, and infrastructure were in shambles. The case of Russian tobacco in Sept. 1990 is illustrative of the problem: “the development of the Soviet market is hobbled by the deterioration of Soviet cigarette factories, shortages of tobacco, paper and other raw materials and widespread hoarding, as well as the banning of Western marketing techniques like advertising and product discounting.”

In February 2022, however, when the “collective west” gleefully imposed sanctions on Russia and compelled companies to exit Russia, the Russian economy and Russian workers did not need foreign investments and expertise. Russians had the benefit of three decades of foreign investments. Russian workers had acquired business and technical skills.

De-Colonization of Russia’s Economy (2022–present)

Russia began de-colonizing its economy. Sanctions liberated Russia. Prof. John Galbraith explains that the effects of sanctions were, in certain respects, a gift to the Russian economy:

The Coca-Cola Company of America

American franchises that exited Russia continue to operate under miscellaneous corporate identities, iterations, and brand names; for example, Coca-Cola is “Dobry Cola.” Its profits have quadrupled, but those profits remain in Russia. Coca-Cola shareholders lose. But Coca-Cola (as branded) is imported through subterfuge, and commands 14% market share; however, “its sales in Russia make money not for [foreign investors], but for Russian billionaires.” Vladimir Putin, “you’re gonna have to answer to the Coca-Cola Company of America”!

Bad Brew for Carlsberg and Heineken

Heineken exited Russia after selling its operations to “Russia’s Arnest Group for a symbolic one euro.” Carlsberg Breweries exited Russia and posted a whopping $5.9 billion loss for FY 2023. And so on.

Outcomes of Economic De-Colonization

Carlsberg’s CEO whined, Russia has “stolen our business.” Carlsberg should submit complaints to the Government of Denmark—a NATO member and vassal state of the United States—for its financial losses. Thus so for all foreign investors that once flourished in Russia. Philip Morris International, however, “has admitted it would ‘rather keep’ its business in Russia than sell on stringent Kremlin terms.” Ukro Nazis and their brain dead Western allies are pressuring PMI to leave. The Kremlin will be ecstatic if PMI is forced to sell for kopeks on the dollar; but PM’s shareholders—including yours truly—will not be happy.

In sum, the Russian Federation and Russians are benefiting from forced sales of assets, operations, rights, and brands; and from three decades of investments in manufacturing, distribution networks, advertising, marketing, employee training, and work/business experiences.

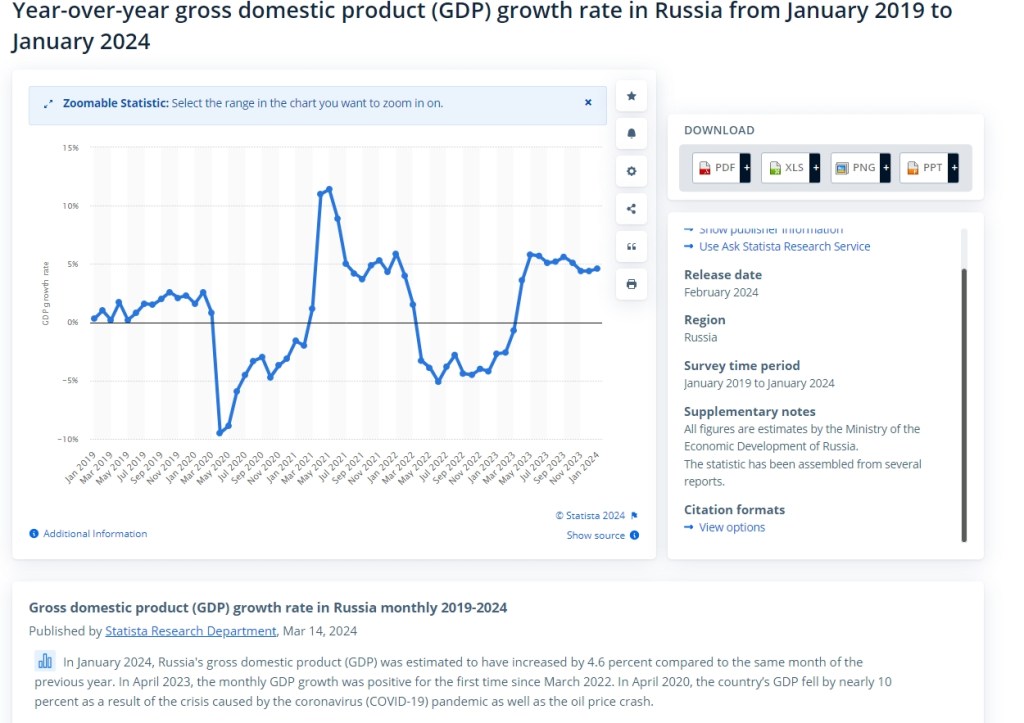

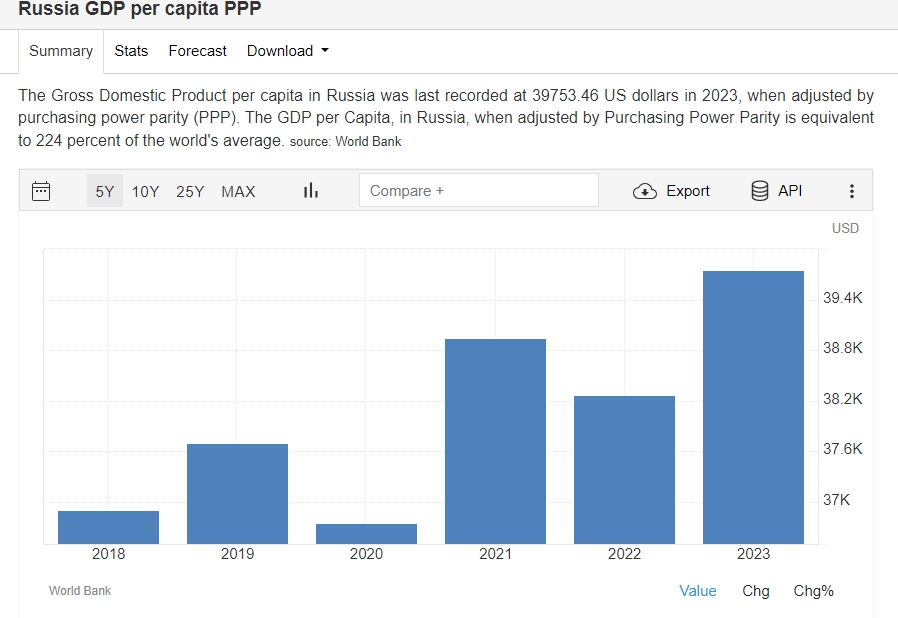

“Haters Gonna Hate”: The Russian Economy is Booming

Hydrocarbons and Minerals

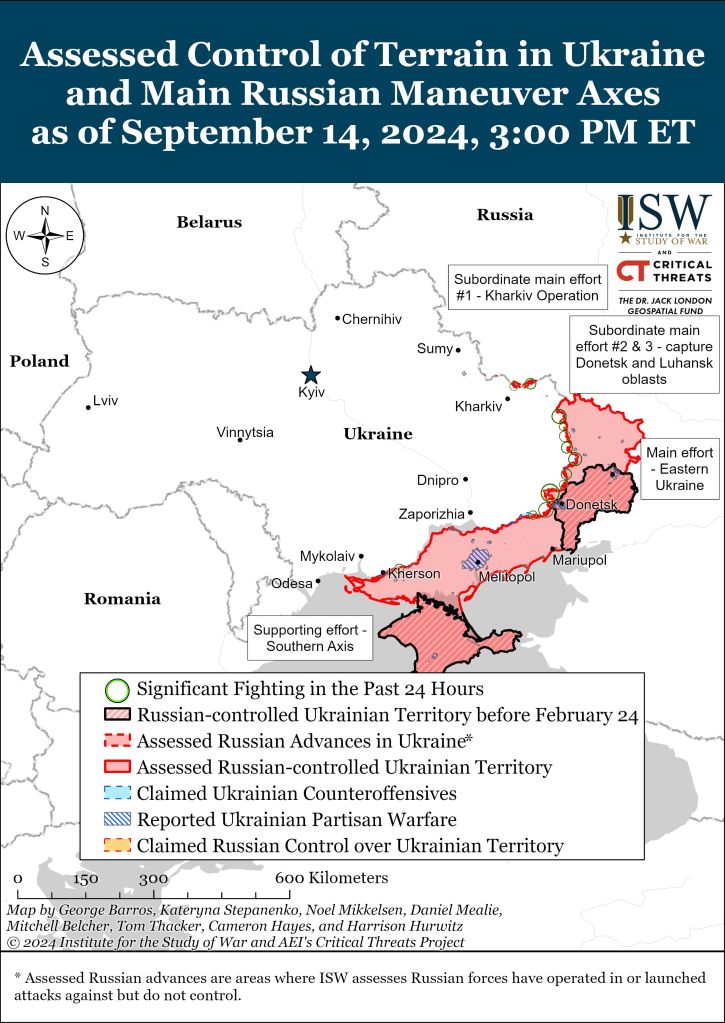

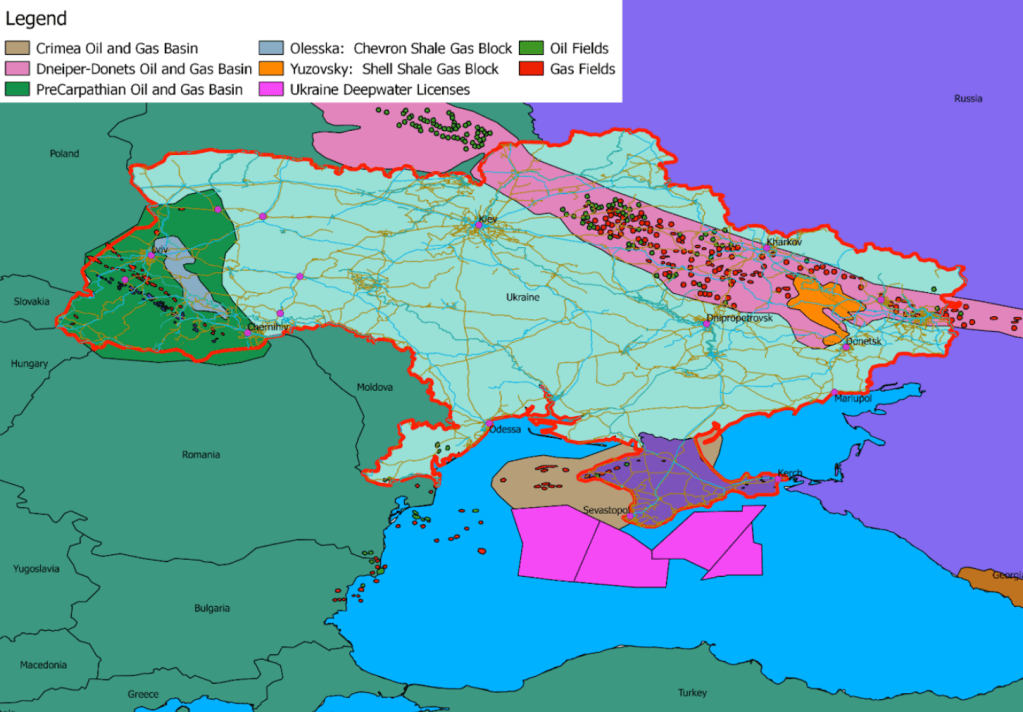

Russia will gain access to Ukraine’s hydrocarbon reserves in the south, north/northeast, and east. The Dnieper-Donetsk region has ca. 80% of Ukraine’s proven reserves; while ca. 6% of proven reserves are in the south: Azov Sea, Black Sea, and Crimea. The four graphics below are for illustrative purposes only.

Maps of Oil & Gas Reserves

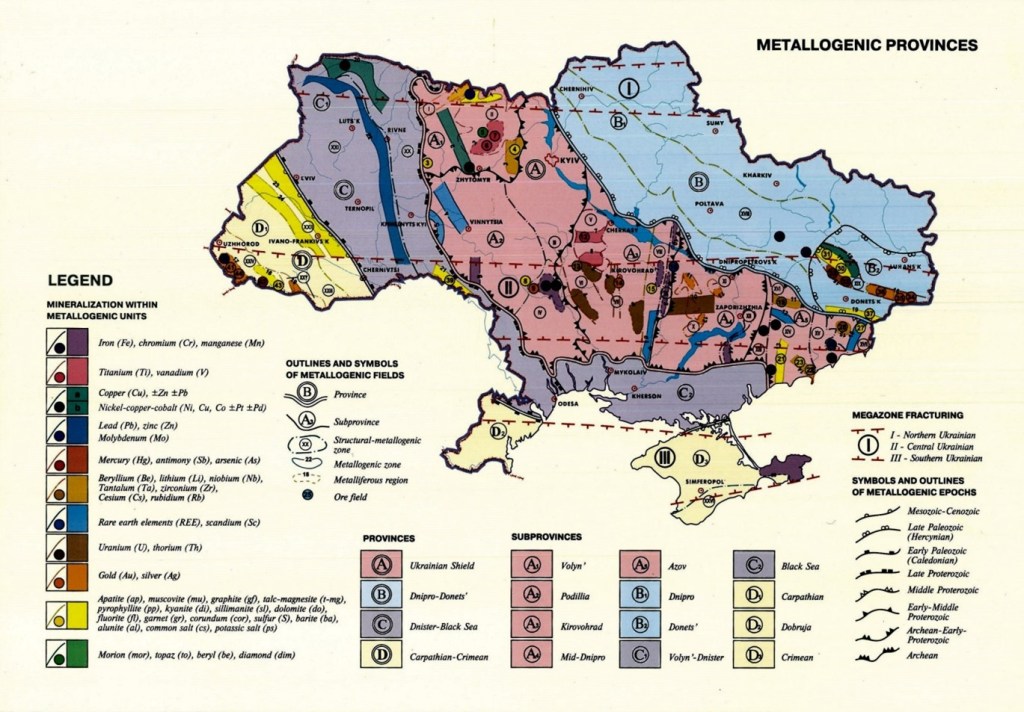

Maps of Mineral Deposits

Agricultural Lands

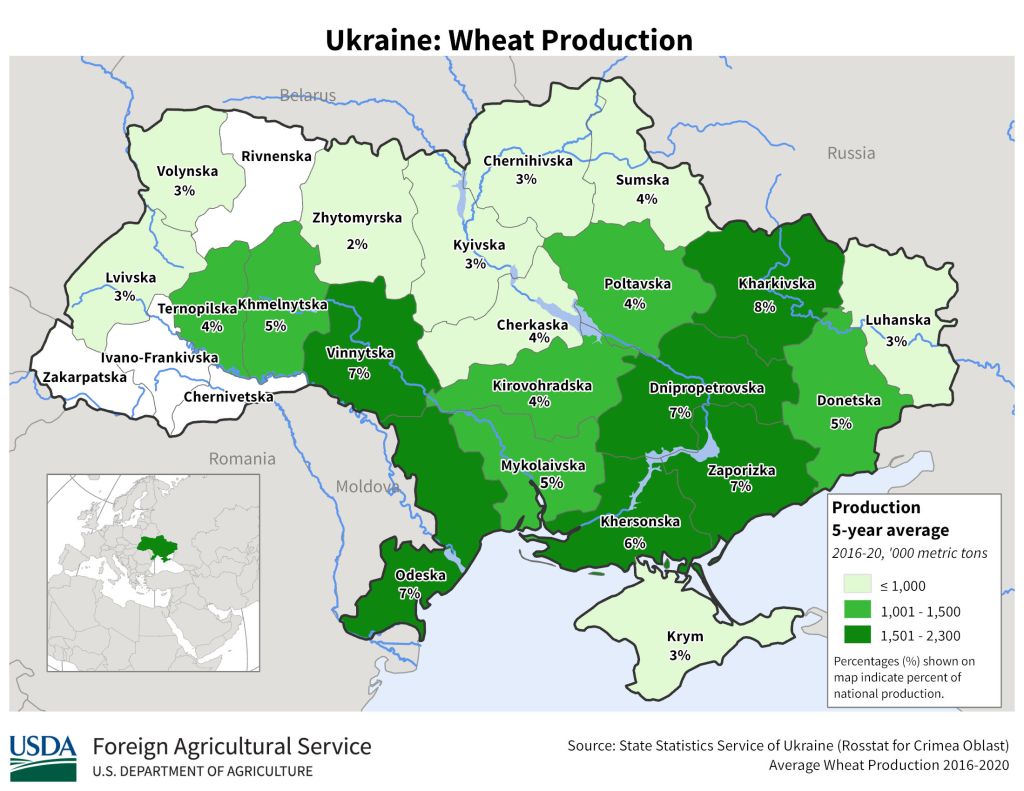

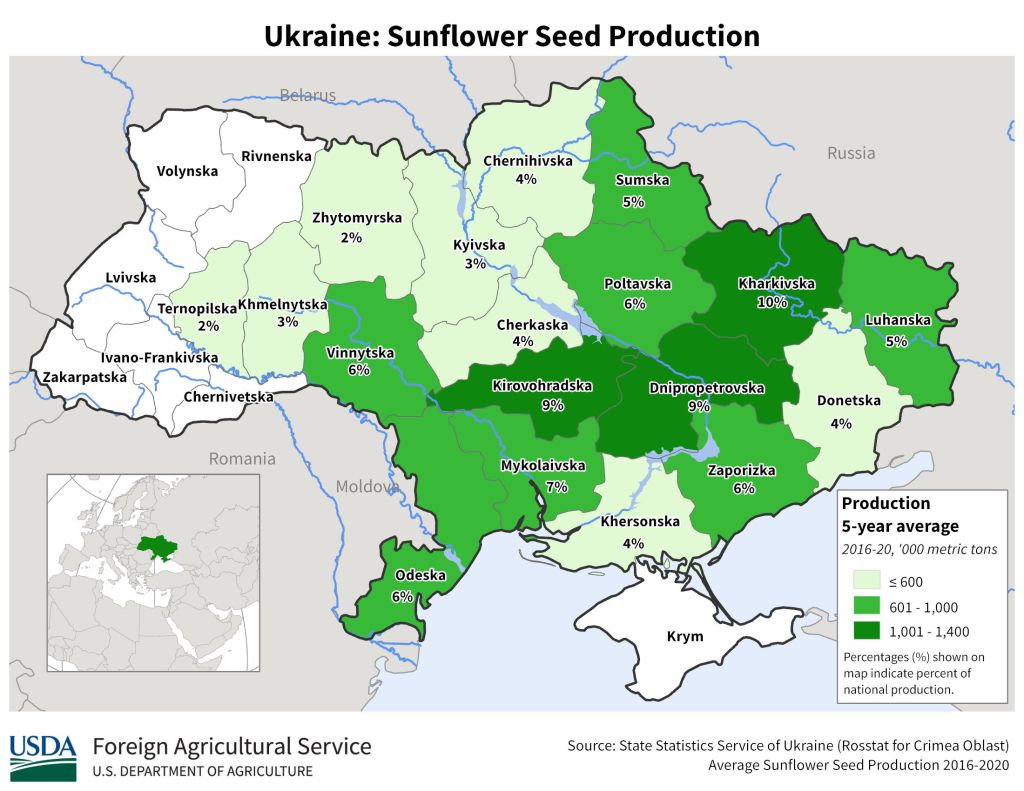

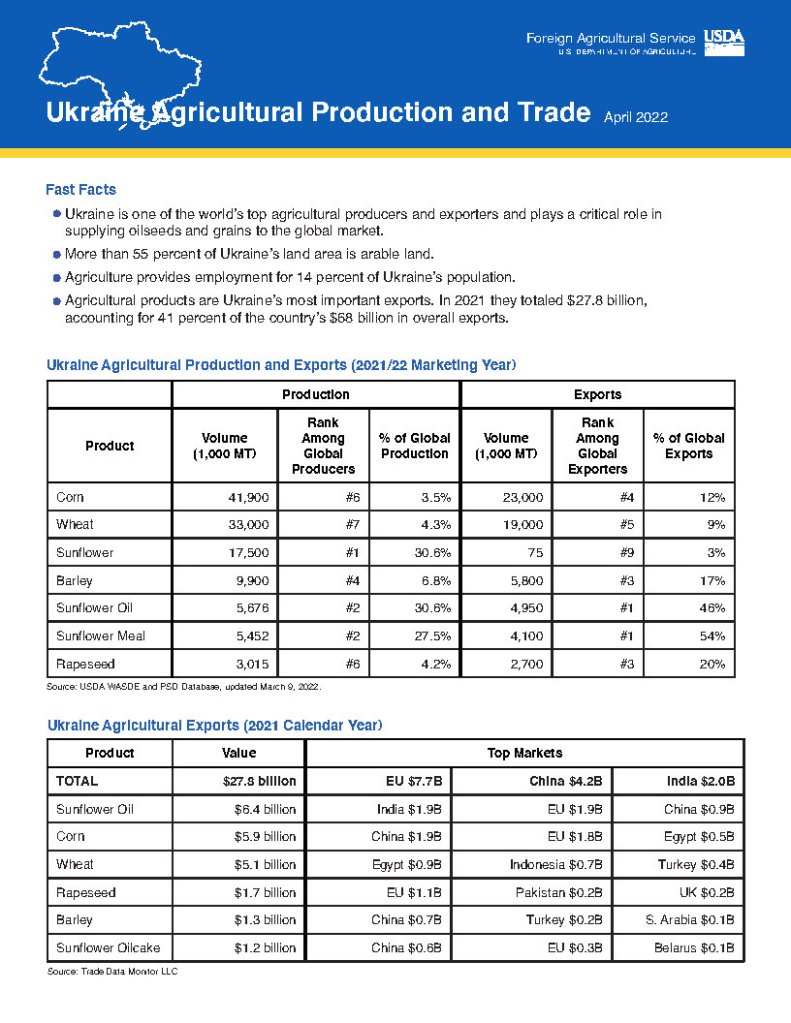

Ukraine has mineral rich soils and abundant water resources, including the 1,367 mile/2,200 km Dnieper, which cleaves Ukraine into two zones before debouching in the Black Sea. Approximately 71% of Ukraine was under tillage before the war, making Ukraine one of the world’s largest suppliers of cereals (viz., wheat, barley, corn, and millet), seeds (rapeseed, sunflower), and soy beans. The maps below, produced by USDA, indicate the most productive regions by crop.

Conclusions

De-colonization of Russia’s economy will continue until foreign investors discover that it is smarter to reject the “Leave Russia” idiots and to remain in, or re-enter, Russia. PMI is aware that the political winds will shift in its favor and is delaying its exit. PMI retains “brand recognition” in Russia, where PMI products (cigarettes, vapes, and heated tobacco) continue to be popular among consumers.

Russia, which already has a sizeable share of the global cereals, seeds, and beans market, will increase its market share once it swallows erstwhile Ukrainian lands and brings them under tillage.2 If Russia landlocks Ukraine, which is likely, the newly-founded Ukrainian rump state will be compelled to ship its produce westward overland, or reach an accommodation with the Kremlin to ship agricultural produce through Russian seaports. The Russian Federation will collect transit fees and port charges on Ukrainian agricultural produce passing through Russian ports.

Russia’s current high shares of the global oil, gas, and mineral markets will increase. This will make Russia a more dominant player in global energy and mineral markets. Europe will be more dependent on Russian gas—exactly the opposite of the result intended by Victoria Nuland, Biden, et al. when the United States Government blew up the Nordstream pipeline.

Appendix: Ukraine’s Pre-war Agricultural Production

You must be logged in to post a comment.